Achieving our Sustainability Transition with the Transition Planning Taskforce (TPT) Disclosure Framework

Q&A with Dr. Ben Caldecott

Dr. Ben Caldecott is the founding Director of the Oxford Sustainable Finance Group at the University of Oxford and serves as the inaugural Lombard Odier Associate Professor of Sustainable Finance, the first-ever endowed professorship in this field. He is also a Supernumerary Fellow at Oriel College, Oxford. Additionally, Dr. Caldecott is the founding Director and Principal Investigator of the UK Centre for Greening Finance & Investment (CGFI), established by UK Research and Innovation in 2021 to advance the global adoption of climate and environmental data analytics by financial institutions internationally. He has conceived and initiated a series of successful organizations, initiatives, and programs related to sustainable finance. Dr. Caldecott chairs the International Transition Plan Network (ITPN) Advisory Group and served as Co-Head of the Transition Plan Taskforce (TPT) Secretariat from early 2022 until November 2024. From 2019 to 2021, he was seconded part-time to the UK Cabinet Office as the COP26 Strategy Advisor for Finance. His contributions include serving on key committees, such as the US Commodity Futures Trading Commission’s Climate-Related Market Risk Subcommittee, the UK Transition Finance Market Review, UK Government’s Green Technical Advisory Group. As a member of the UK Green Finance Taskforce, he chaired its workstream on implementing the Task Force on Climate-related Financial Disclosures (TCFD).

Emily Chien: Thank you for joining me, Dr. Caldecott to speak about the timely and important work of the Transition Planning Task Force (TPT). You are a well-recognized global thought leader in sustainability and finance, as a practitioner, academic, business scholar, and have been serving as TPT Secretariat Co-Head since 2022. How and why did you get involved with the TPT?

Ben Caldecott: Thank you for the opportunity to discuss the TPT’s impact and progress. It is one of the most impactful things I have had the opportunity to be involved with.

In the run-up to COP26 in 2021, we saw a significant increase in net-zero pledges from companies and financial institutions, which was a highly encouraging development. However, these pledges came with a critical question: how would these organizations actually deliver on their commitments? What was needed was a standardized, accountable framework to guide companies in translating these commitments into actions.

Around the same time, the UK became the first jurisdiction to announce that it would be introducing mandatory disclosure requirements for private sector climate transition plans. This announcement highlighted the urgency of defining what a high-quality climate transition plan should look like. Without a coherent framework, there is a real risk that companies might create plans that varied greatly in quality and ambition, limiting the ability of stakeholders — investors, regulators, and the public — to assess them effectively. The UK finance ministry (HM Treasury) thus established an industry-led task force to develop a “gold standard” for transition plans.

In early 2022, I was asked to co-head the Secretariat for the TPT with Kate Levick of E3G, an international climate think tank. I was honored to join, as I knew this work would be both challenging and impactful. We began at the start of 2022, and over the next 2.5 years have worked with over 500 organizations globally to develop our outputs. We involved major international companies and financial institutions and engaged with regulators from other jurisdictions such as the Japanese Financial Services Agency and the Monetary Authority of Singapore. This collaboration ensured that our work would be globally applicable and adaptable to various regulatory contexts, not just within the UK.

Our work culminated in October 2023 with the publication of the TPT Disclosure Framework and related implementation guidance. A major milestone followed when, in June 2024, the IFRS Foundation announced it would assume responsibility for the TPT’s disclosure materials, providing significant endorsement of the framework. The inclusion of TPT materials to guide entities implementing IFRS S2 Climate-related Disclosures enhances the global reach and credibility of our work.

Chien: Building on this helpful context, how do we unlock access to capital to enable companies to become more sustainable?

Caldecott: Solving the climate crisis will require much more than investing solely in green companies. Most of the global economy is based on activities that are, as of now, polluting and unsustainable. This means the transition must involve helping these parts of the economy access the capital and resources they need to shift towards sustainability. Transition planning is about facilitating that shift — making it possible for companies in all sectors to adopt credible, well-defined pathways to decarbonization and greater environmental and social sustainability.

Transition plans act as an essential tool in unlocking the capital and financial services needed to support these shifts. By creating and disclosing a credible transition plan, a company signals to investors and lenders that it is prepared to manage climate-related risks and take advantage of climate-related opportunities, as well contribute to wider societal objectives. For financial institutions, this reduces risk and uncertainty, making these companies more attractive. This, in turn helps to mobilize capital into the real economy where it’s most needed to drive decarbonization.

In addition, a clear transition plan can underpin various types of new financial instruments — like sustainability-linked bonds and loans, where the terms are linked to the company’s progress on key performance indicators related to their transition. By aligning financing terms with sustainability performance, these instruments can incentivize companies to accelerate their transition while giving investors confidence that their capital is supporting genuine, measurable progress.

Chien: So, the transition plans are for both investors as well as the businesses themselves to have a robust and formalized plan on how this all fits together. There are multiple users for different purposes.

Caldecott: Absolutely. So who are the preparers of these plans? The answer is companies, but we don't just mean non-financial companies, we also mean financial companies, financial institutions of all different kinds.

Chien: What’s the theory of change for the TPT?

Caldecott: The TPT’s theory of change centers on making transition plans an integral part of business strategy. A credible transition plan should not be a separate statement or a public relations exercise — it must be embedded in the company’s core strategy and operational plans. This means that the plan should articulate the company’s long-term sustainability goals and how it intends to achieve them, aligning with day-to-day operations and decision-making processes.

To make this actionable, the TPT Disclosure Framework sets out five core elements that transition plans should address: foundations, implementation, engagement, metrics and targets, and governance. These elements create a structured approach that companies can follow to outline not only their decarbonization targets but also the concrete steps they’ll take to meet them. This includes detailing governance structures, establishing accountability mechanisms, setting clear targets, and specifying how progress will be monitored and incentivized.

The TPT framework also emphasizes that transition plans should account for a company’s role in the broader economy. This is especially relevant for sectors where decarbonization will require significant industry-wide collaboration or regulatory support. By addressing both internal decarbonization and external contributions to a sustainable economy, the framework helps companies create plans that are robust, comprehensive, and aligned with global climate goals.

The TPT Disclosure Framework

Source: TPT Disclosure Framework Final Report (2023).

Chien: What role do you see for financial institutions in the broader decarbonization ambitions?

Caldecott: Financial institutions are uniquely positioned to drive both direct and systemic decarbonization. Traditionally, the focus has been on financial institutions setting portfolio decarbonization targets — essentially aiming to reduce the carbon intensity of the portfolio of companies they hold as investments or lend to. However, this approach can sometimes result in unintended consequences, such as divesting from high-emitting sectors that still need financing to transition.

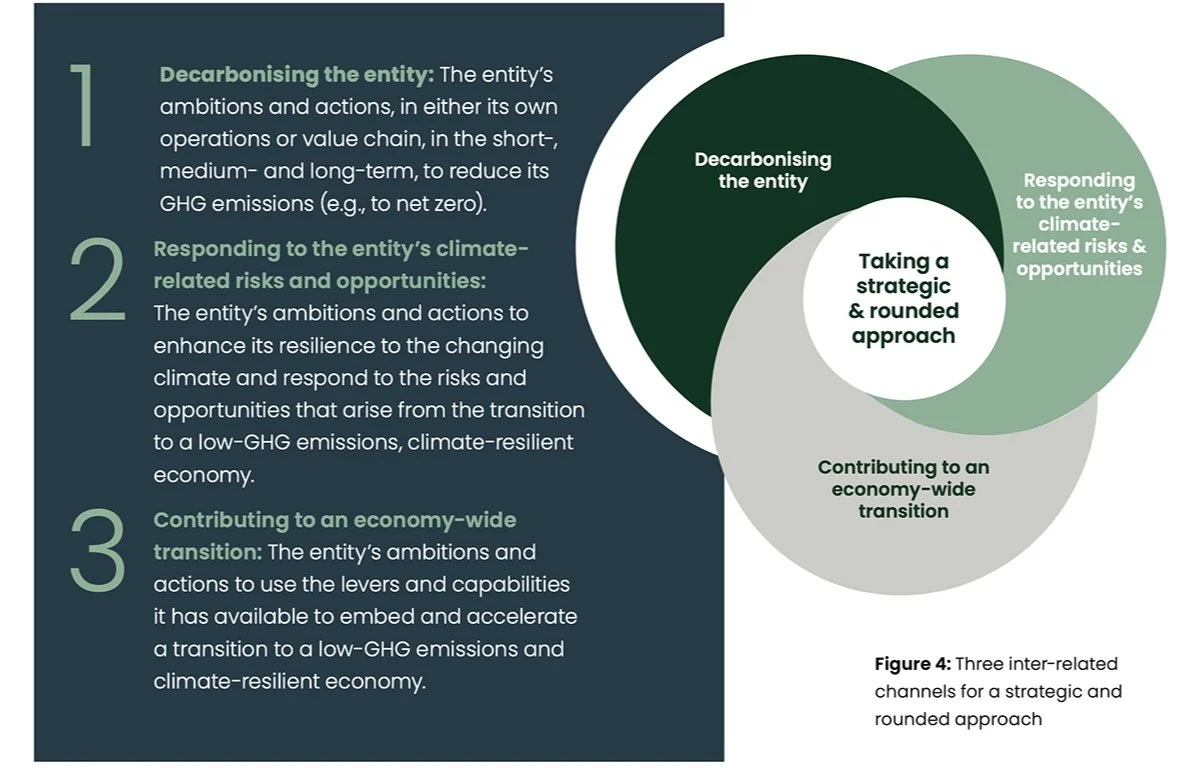

The TPT Disclosure Framework encourages financial institutions (and all other preparers) to take a “strategic and rounded approach” that considers not only how they will decarbonize their own portfolios but also how they can support decarbonization across the real economy. This broader view means looking at ways to finance transition efforts in industries that require substantial support to achieve net zero, rather than simply avoiding emissions-heavy sectors.

For financial institutions, this involves creating transition plans that outline both portfolio targets and strategies to support their clients’ and investees’ transition journeys. The aim is to ensure that financial institutions are not just meeting their own sustainability goals but are also playing an active role in enabling systemic decarbonization across the economy. This dual approach helps prevent “greenwashing” while aligning financial flows with real-world sustainability outcomes.

Source: TPT Disclosure Framework Final Report (2023).

Chien: What are other ways transition plans can be useful?

Caldecott: Transition plans serve as powerful tools, far beyond their initial role of disclosing sustainability commitments to capital markets. Their versatility means they can be utilized across a wide array of contexts, creating value not only for investors but also for regulators, policymakers, and companies themselves.

To begin with, transition plans are vital for regulatory oversight and risk management. As regulators seek to understand how companies and financial institutions are preparing for the transition to a low-carbon economy, transition plans provide an invaluable source of insight. Regulators — particularly central banks and financial supervisors — can use these plans to assess the resilience of individual institutions and the broader financial system to climate-related risks. By examining the trajectory and feasibility of companies’ transition plans, regulators can better understand potential vulnerabilities, anticipate risks to financial stability, and monitor alignment with national and international climate goals.

Transition plans are also critical for policy development and can help bridge gaps between private sector action and public policy. Policymakers are increasingly looking to companies’ transition plans to understand not only the level of ambition but also the concrete steps companies are taking — or struggling to take — toward decarbonization. These plans highlight the dependencies companies face, such as the need for specific technologies, regulatory support, or infrastructure development. If, for instance, a substantial number of companies identify technological or regulatory gaps that could hinder their progress, policymakers can use this feedback to design more effective and supportive policies. Transition plans thus become a direct line of communication between the private sector and policymakers, facilitating a more responsive and adaptive regulatory environment.

Another emerging application for transition plans lies within sustainability-linked financial instruments such as green bonds, sustainability-linked bonds, and sustainability-linked loans. These financial products often feature key performance indicators (KPIs) tied to the issuer’s or borrower’s sustainability targets, with financial incentives for meeting those targets. Transition plans can serve as the foundation for setting these KPIs, creating a direct link between the company’s transition strategy and its financing terms. For instance, a company might issue a sustainability-linked bond with interest rates that are contingent upon meeting specific emissions reduction milestones laid out in its transition plan. This alignment between financing terms and transition performance not only incentivizes companies to achieve their sustainability goals but also provides investors with greater confidence that their capital is supporting meaningful climate action.

Looking forward, there is significant potential to embed transition plans as prerequisites for accessing public financial support. For example, if a company seeks public loans, subsidies, or guarantees — whether related to renewable energy projects, R&D, or infrastructure development — having a credible, well-defined transition plan could be required. This could extend to public-sector financing mechanisms like export credit guarantees, tax incentives, and programs such as the U.S. Inflation Reduction Act (IRA) which offers substantial tax credits for clean energy initiatives. By tying public financial support to robust transition plans, governments can ensure that public funds are effectively leveraged to support climate goals, channeling resources toward companies that have a credible, actionable pathway to decarbonization.

Additionally, transition plans could play a role in trade and market access requirements through mechanisms like carbon border adjustments. For example, the EU’s Carbon Border Adjustment Mechanism (CBAM) is designed to levy fees on imported goods based on their embedded carbon emissions, essentially placing a price on carbon-intensive imports to encourage cleaner production practices. In the future, trade partners could potentially require companies to have credible transition plans to access certain markets or benefit from reduced border tariffs. By integrating transition plans into trade policy, governments could encourage global alignment with climate goals, pushing companies around the world to develop credible decarbonization strategies.

Transition plans offer institutional investors a more structured basis for engaging with portfolio companies. Investors are increasingly interested in understanding not only whether companies have net-zero commitments but also how they plan to achieve them. A transition plan provides a clear roadmap for investors to monitor progress, hold companies accountable, and engage constructively on areas where additional effort may be needed. This can foster a more collaborative dynamic between investors and companies, where transition plans act as both a tool for transparency and a framework for targeted stewardship and engagement.

Chien: What's in it for companies to adhere to the more detailed and robust TPT Disclosure Framework? What are the benefits? Any downsides?

Caldecott: There are many incentives for companies to embrace the TPT Disclosure Framework, and I’ll highlight a few. First and foremost, it provides a structured process to think strategically about both the challenges and opportunities of transitioning to net zero. For companies, especially large ones operating across complex global supply chains, the transition is not a simple task. The Framework helps companies break this down into manageable parts, making it clear what they need to focus on and how to align their strategies accordingly.

Another major benefit is that it strengthens companies’ engagement with their stakeholders — employees, customers, investors, and governments — who increasingly expect concrete actions on sustainability. Transition plans communicate that the company is taking this seriously, with a robust and transparent approach to achieving measurable outcomes. This, in turn, enhances a company’s reputation, attracting talent and gaining customer loyalty.

Additionally, a well-articulated transition plan helps companies identify what support they need to accelerate progress, including key dependencies such as regulatory changes, technological innovations, and supply chain transformations. Knowing these dependencies allows companies to engage in more meaningful dialogue with policymakers and technology providers, creating pathways for collaboration and innovation that benefit both business and society.

From a financial perspective, there’s the potential for a significant advantage: lower costs of capital. As markets increasingly incorporate climate risk, companies that demonstrate proactive management of these risks can access capital at more favorable terms. We’re already seeing a climate risk premium in financial markets, where companies with unaddressed climate risks face higher capital costs, whereas those with clear transition plans can benefit from comparatively lower financing costs. This dynamic will only intensify as more investors integrate climate considerations into their risk assessments, so having a transition plan will become a financial imperative.

However, there are also potential downsides. The main challenge is that developing a transition plan requires resources and commitment. Companies may need to invest in data collection, internal capacity-building, and potentially new technologies to track and meet their targets. For some, especially smaller companies, this might feel daunting initially. But as more companies adopt the framework and regulators provide guidance, I believe this will become a manageable process — particularly since it’s meant to be repeatable, allowing for continuous improvement over time. Transition planning will become a fundamental part of good business practice, and those that embrace it early will be better positioned as regulatory expectations evolve.

Chien: Now that the IFRS has assumed responsibility for the TPT Disclosure Framework, guidance and the materials, what's next? Are other jurisdictions also developing transition plan disclosure frameworks? How do you see this impacting other companies, jurisdictions, and how does extraterritoriality come into play?

Caldecott: The transfer of the TPT Disclosure Framework and related materials to the IFRS Foundation is a critical milestone that underscores its global relevance. We intentionally designed the TPT Framework to be international in scope. From the outset, we involved a diverse group of participants — including companies, regulators, and financial institutions from a wide range of jurisdictions — to ensure it could be applicable anywhere.

The adoption of IFRS S2 Climate-related Disclosures is expected to broaden the TPT Framework’s influence. As IFRS standards are adopted globally, the TPT’s approach to transition planning can serve as a foundation for companies worldwide, ensuring consistency and quality in sustainability disclosures. This has far-reaching implications for multinational corporations and investors who operate across borders and need standardized data to make informed decisions.

Other jurisdictions are indeed moving in a similar direction. The UK and the EU are introducing mandatory transition plan disclosure requirements for large companies and financial institutions. The EU’s approach includes extraterritorial provisions, including through the Corporate Sustainability Due Diligence Directive (CSDDD). This means that non-EU companies deriving revenues in the EU above a certain level will need to comply with EU standards, even if their headquarters are outside Europe. This is a trend we’re likely to see more of, as jurisdictions aim to prevent regulatory arbitrage and maintain a level playing field for companies competing in global markets.

For US companies, this shift is particularly relevant. Even if transition plan disclosure isn’t yet mandatory in the US, companies doing business in Europe may find themselves subject to these requirements. Increasing alignment between international frameworks, such as IFRS S2 and the TPT, will facilitate compliance and ensure that these companies are not caught off guard by differing requirements. Overall, the IFRS’s stewardship of the TPT materials will likely catalyze broader adoption, supporting a globally consistent approach to transition planning.

Chien: There are so many Principles, Frameworks, Initiatives, and Standard setting approaches that companies and jurisdictions are juggling which are complex, fragmented, inconsistent and costly. Transition Planning is no exception. How do we square this circle?

Caldecott: This is a very real challenge for companies. The landscape of sustainability frameworks has grown rapidly, leading to a confusing array of principles, standards, and initiatives that can feel overwhelming. We have confusion like where does the Science-based Targets initiative (SBTi ) fit and how does that relate to VCMI and how does that relate to CDP and all these other different things. In addition to climate, we have critically important global negotiations on biodiversity focused on the Kunming-Montreal Global Biodiversity Framework and now the Taskforce on Nature-related Financial Disclosures (TNFD). There are also frameworks that address broader social impacts, like the just transition, and other sustainability issues like water stewardship.

I believe we’re moving towards convergence, where the various frameworks and principles start to align into a coherent whole. We’ll start to see an integrated approach that aligns with major standards, like IFRS S2. This would create a central organizing framework for climate disclosures, with modular connections to other sustainability areas like biodiversity and social impact.

Transition planning provides companies with a structured way to understand and navigate this landscape. The TPT Framework effectively creates a map that helps companies identify where various principles and initiatives fit and how they relate to each other. So if a company is looking to include carbon offsets in its transition plan, it can refer to the TPT’s guidance on best practices and understand which principles are relevant — such as the VCMI or the Oxford Offsetting Principles — and how this relates to all the other issues they need to consider. Ditto with things like SBTi and how that entity-level target then relates to other dimensions of climate action and climate-related risk management.

Ultimately, we’re moving towards a common language for sustainability, where transition planning serves as a central, practical framework able to accommodate the multiple dimensions of sustainability in a coherent, actionable way. This will help reduce confusion, improve efficiency, and make it easier for companies and investors to focus on what really matters: delivering impactful, measurable outcomes.

Chien: I especially like your description of the TPT Disclosure Framework as a way of pulling it all together. So in summary, what are the most important elements that we should take away from the TPT's work?

Caldecott: That it's easy to get started! And, that this is designed to be a process that is repeatable, it is part of the business strategy. And the best thing to do is to do one, and then learn from that process, then repeat and improve. So don't be daunted by the fact it sounds like it's a new thing and there's a new framework, yes, another framework, more guidance.

In fact, it will actually make your life easier because it can actually help you figure out the complex landscape — where all these things fit in and fit together and how they relate to one another.

Chien: That's music to everybody's ears. And I'm curious, for the TPT, what are you most proud of and what gives you hope in this area of transition?

Caldecott: Yes, we’ve worked for the two and a half plus years now in a truly multi-stakeholder way, involving different types of real economy companies, financial institutions, and regulators around the world. So that's really important. And the work has really spoken to a need. I think people interact with these ideas and then say, yes that's actually quite a good idea and we need it. That's one of the main reasons why it's grown very rapidly and there's been a lot of interest in TPT and transition planning more generally.

Moreover, creating something that is robust but adaptable is quite difficult. We've taken a very sensible and pragmatic approach, and also worked really hard to make sure it doesn't duplicate. For example, where it makes sense, the TPT Disclosure Framework builds off existing work such as components identified by the Glasgow Finance Alliance for Net Zero (GFANZ).

Chien: Ben, one final question in closing, is there anything that we have missed that you'd like to add?

Caldecott: One final point I’d emphasize is that transition planning is about much more than compliance and companies successfully navigating a complex climate-related risks and opportunities; it’s also about making a genuine impact on society and the environment. Large and small companies alike have a role to play in shaping a sustainable future, and transition plans provide a structured way to think through and execute on that responsibility. This is about mainstreaming social responsibility at large. And that's one of the reasons why it's truly exciting.

Chien: Thank you for sharing your reflections. It’s exciting to consider how businesses and governments can use transition plans that benefit from the TPT Disclosure Framework and its inclusion in the IFRS family to inform business strategy, economic activities, decarbonization pace and social impact.

Caldecott: Thank you so much, Emily. It’s my pleasure.

About the Author:

Emily A. Chien is a Harvard Advanced Leadership Initiative Senior Fellow, where she works at the intersection of sustainability, climate solutions, and AI enablement. She serves on the IFRS Foundation Advisory Council, which advises the ISSB and IASB, international sustainability and accounting standard-setting boards, respectively. Previously, she led IBM’s Global Climate Risk Offerings and related tech partnerships. A long-time champion of and innovator in AI and digital, Emily led AI business transformations serving IBM clients in banking, investments, and insurance and was appointed a 2021 Fellow with the World Economic Forum AI/ML multi-stakeholder “Responsible Use of Technology” industry-wide Steering Committee and program.

This Q&A has been edited for length and clarity.